News & Media

Market Perspectives – Third Quarter, 2024

CitizensTrust – A Division of Citizens Business Bank

Click on images below to enlarge.

Financial markets continued to rally in the third quarter as the economy displayed solid growth and expectations increased for a “soft landing” to be manufactured by the Fed. The bond market rallied, and interest rates fell as the Federal Reserve cut the Fed Funds rate after holding rates steady for the past fourteen months.

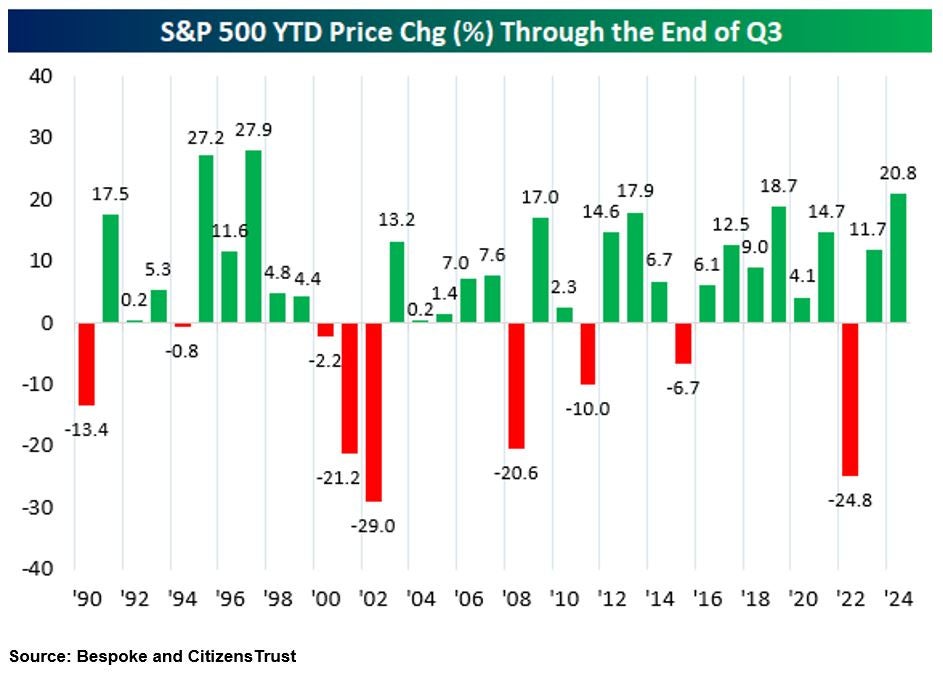

The S&P 500 Index rose 5.9% in the quarter adding on to the double-digit gains achieved in the first half of the year. The Index is now up 22% YTD and has hit forty-two new all-time highs thus far this year.

The S&P 500’s gain through the first three quarters of the year is its best performance since 1997. Unlike the first half of the year, which was dominated by the performance of technology stocks, the market broadened out in the third quarter and participation was widespread. The tech-heavy NASDAQ composite gained 2.8% in the quarter, lagging the more diversified S&P 500. The semiconductor industry, which was the best performer in the first half, declined in the third quarter. An indication of the broader market performance during the quarter is the S&P 500 equal-weighted index rising 9.6%. Mid and small-cap stocks also outperformed the S&P 500 by a wide margin.

In the third quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, rose 9.2% and are up 14.5% YTD. Small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, increased by 9.3% and are now up 11.0% YTD. The U.S. market slightly underperformed international indices during the quarter. International Developed markets, as measured by the EFA ETF, rose 6.8% during the quarter and is up 13.0% YTD. Emerging markets, as measured by the EEM ETF, were up 7.7% and on a YTD basis they have gained 14.8%. China is the largest emerging market and Chinese stocks reacted positively to several stimulus measures announced by the government in September. Globally, the MSCI World Index gained 6.4% in the third quarter and is now up 18.5% YTD.

Interest Rates

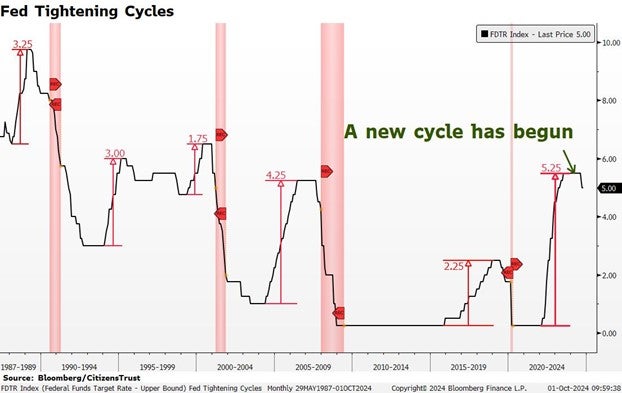

The biggest news of the quarter was the Fed moving from its stance of “higher for longer” to cutting the Fed Funds rate for the first time since March of 2020. The fourteen-month pause at 5.5% was relatively long, and the reduction of 50 basis points in September to 5.0% was higher than expected. This means the Fed concluded that monetary policy was too restrictive.

The market continues to expect that the Fed will be lowering interest rates for the next several quarters. The Fed is confident that they have largely tackled the inflation problem and will likely continue to cut the Fed Funds rate until they reach their theoretical level of a neutral monetary policy. There are two more Fed meetings this year, and the market currently expects at least a 25 basis-point cut in rates at both meetings.

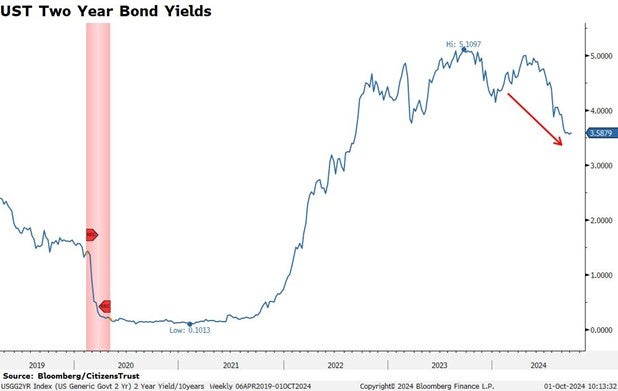

The two-year Treasury bond yield has been falling since the first quarter in anticipation of a slowing economy and less restrictive Fed. As yields fell in the third quarter and bond prices rose, the performance of the bond market fully recovered from its decline in the first half of the year. The Bloomberg Aggregate U.S. Bond Index gained 5.2% in the third quarter and is now up 4.5% on a YTD basis.

The Economy

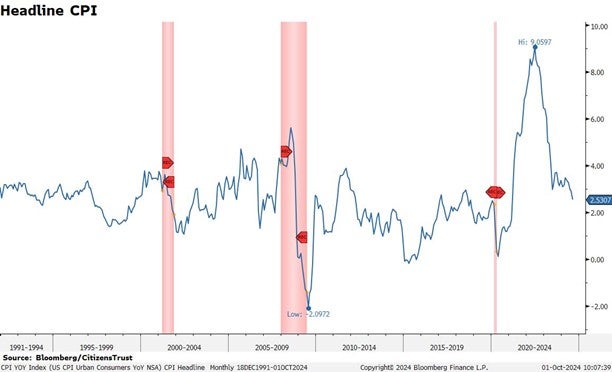

U.S. GDP growth has been strong in the past six months. Second quarter GDP growth was 3.0% and estimates for growth in the third quarter are near the same level. Consistent levels of consumer spending and abnormally high levels of government spending have fueled the economy this year and proven growth forecasts to be too low. While some consumer measures appear to be stressed, recent levels of high inflation have forced consumers to spend more on basic expenditures. The good news is that inflation levels have come back down and although prices remain high, the rate of change has returned to normal levels.

The government’s fiscal year ended in September and spending remained elevated. The most current estimates project a Fiscal Year 2024 budget deficit of roughly $1.9 trillion dollars which equates to nearly 7% of the U.S. economy. This level of government spending is abnormally high and about double the pre-pandemic seven-year average of 3.4%. While the economy has remained resilient, the labor market is not nearly as tight as it was a year ago.

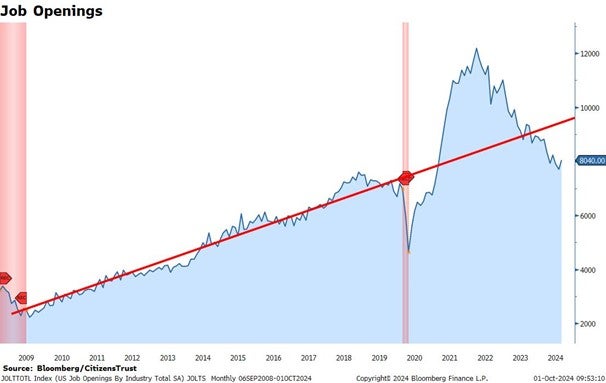

There has been a steady decrease in the number of Job Openings reported by the Bureau of Labor and Statistics. This is regarded as an indicator of a softer labor market. The monthly Non-Farm Payroll report has also shown a decline in job growth and revisions to previous reports have been significantly negative. The Fed cited both measures as reasons to be less restrictive going forward.

The Quarter Ahead

The presidential election will obviously be the big event in the fourth quarter. Regardless of the outcome, its conclusion will be an “uncertainty clearing” event for financial markets which is why stocks usually rally after an election. It should be noted that next year will have an unusual amount of tax and spending issues that a new administration will be forced to address. Many provisions from the Tax Cut and Jobs Act passed in 2017 will expire at the end of 2025. In addition, the federal debt limit will be reinstated in January of 2025 which will force the new congress to deal with spending limits.

A new direction in Fed policy is a meaningful event and one we view as positive for financial markets. Corporate earnings continue to grow in this economic expansion and forecasts for future economic growth have consistently been too low for the past two years. As uncertainty is resolved in the fourth quarter, the market will assess the robust expectation for 2025 earnings growth of roughly fourteen percent. This would lead to the highest level of corporate earnings ever achieved.

Corporate earnings have remained strong and have now shown year-over-year growth for three straight quarters. As 2024 earnings guidance is largely set by most companies by the end of the first quarter, expectations are for a 10.6% increase in S&P 500 earnings this year and another double-digit increase in 2025. These bottom-up estimates are always subject to revisions, but current expectations represent a positive outlook. In addition, U.S. earnings growth is stronger than most other markets, as is our economic growth, and both remain supportive of relatively high valuations.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust