News & Media

Market Perspectives – Second Quarter, 2024

CitizensTrust – A Division of Citizens Business Bank

Click on images below to enlarge.

Equity markets continued to rally in the second quarter as the economy continued to be resilient and expectations of a “soft landing” by the Fed increased. The bond market recovered slightly as interest rates rose and the Federal Reserve remained on pause, yet continued to signal that their next move would likely be to cut interest rates at some point later this year.

Equity Markets

The S&P 500 Index rose 4.3% in the quarter adding on to the double-digit gains achieved in the first quarter. The Index is now up 15.3% YTD and has hit 31 new all-time highs in the first half of the year.

Any discussion of equity market performance this year must begin with the outstanding performance of the largest technology companies which have thus far benefited the most from the rapid growth in artificial intelligence (AI) spending. Driven by the largest companies such as Microsoft (MSFT), Nvidia (NVDA), and Apple (AAPL), the tech-heavy NASDAQ Composite led the market with an 8.5% gain in the quarter, roughly double the S&P 500. The S&P technology sector gained nearly 14% in the quarter, while no other sector had a double-digit gain, and seven of the eleven sectors were down. Seven of the ten largest companies in the U.S. are benefitting from the emergence of AI technology and they now make up a collective weight of 33% of the S&P 500 Index. The dominance of these large companies is obvious when comparing the market-cap weighted S&P to an equal weighted version of the index.

Any discussion of equity market performance this year must begin with the outstanding performance of the largest technology companies which have thus far benefited the most from the rapid growth in artificial intelligence (AI) spending. Driven by the largest companies such as Microsoft (MSFT), Nvidia (NVDA), and Apple (AAPL), the tech-heavy NASDAQ Composite led the market with an 8.5% gain in the quarter, roughly double the S&P 500. The S&P technology sector gained nearly 14% in the quarter, while no other sector had a double-digit gain, and seven of the eleven sectors were down. Seven of the ten largest companies in the U.S. are benefitting from the emergence of AI technology and they now make up a collective weight of 33% of the S&P 500 Index. The dominance of these large companies is obvious when comparing the market-cap weighted S&P to an equal weighted version of the index.

While the S&P 500 is up 15.3% YTD, the equal-weighted version is only up 4% YTD. Looking at the broader market through this equal-weighted lens shows that it is down slightly from its peak at the end of 2021. The S&P 500 is up 14.3% over that same period, highlighting how a disproportionate amount of the market’s gain since the 2022 market bottom has come from technology stocks.

While the S&P 500 is up 15.3% YTD, the equal-weighted version is only up 4% YTD. Looking at the broader market through this equal-weighted lens shows that it is down slightly from its peak at the end of 2021. The S&P 500 is up 14.3% over that same period, highlighting how a disproportionate amount of the market’s gain since the 2022 market bottom has come from technology stocks.

In the second quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, fell 3.3% and are up 4.9% YTD. Small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, also fell 3.3% and are up 1.6% YTD. The U.S. market continued to outpace international indices during the fourth quarter. International Developed markets, as measured by the EFA ETF, fell 0.2% during the quarter and is up 5.8% YTD. Emerging markets, as measured by the EEM ETF, were up 4.4% and on YTD basis they have gained 6.7%. Globally, the MSCI World Index gained 2.9% in the second quarter (thanks to the U.S.) and is now up 11.4% YTD.

Interest Rates

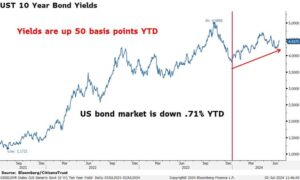

Unlike equities, the bond market has struggled to produce positive returns this year. With UST ten-year yields rising over 50 basis points this year, the Bloomberg Aggregate U.S. Bond Index remains down .71% on a YTD basis. The bond market has spent the entire first half of the year reducing its rate cut expectations from six or seven, down to one or two. This change was primarily driven by a pause in the declining inflation measures, and an economy that has been resilient in spite of the rise in interest rates.

Unlike equities, the bond market has struggled to produce positive returns this year. With UST ten-year yields rising over 50 basis points this year, the Bloomberg Aggregate U.S. Bond Index remains down .71% on a YTD basis. The bond market has spent the entire first half of the year reducing its rate cut expectations from six or seven, down to one or two. This change was primarily driven by a pause in the declining inflation measures, and an economy that has been resilient in spite of the rise in interest rates.

The Fed wants to see “further and consistent” improvement in the common inflation measures before it is convinced that the fight against inflation has been won. While the economy did slow in the first half of the year, the progress in lowering inflation stalled for a few months, and the Fed will want to see several months of better inflation readings before it cuts the Fed Funds rate. So as of now, the policy of “higher for longer” prevails.

The Fed wants to see “further and consistent” improvement in the common inflation measures before it is convinced that the fight against inflation has been won. While the economy did slow in the first half of the year, the progress in lowering inflation stalled for a few months, and the Fed will want to see several months of better inflation readings before it cuts the Fed Funds rate. So as of now, the policy of “higher for longer” prevails.

Looking back at 50 years of interest rate cycles, the longest period the Fed has ever been able to “pause” and hold rates after they were done hiking was the period from June of 2006 to August of 2007. The Fed held rates near today’s levels for 14 months. The Fed’s last rate hike was in July of last year, and we have had a Fed Funds rate of 5.5% for 11 months. By the time we produce this letter next quarter, we will be just passing that 14-month mark into record territory. The Fed will conduct two FOMC meetings this quarter in July and September and of course there will be three more inflation readouts before their September meeting.

The Economy

U.S. GDP growth has slowed significantly in the first half of this year in comparison to the second half of last year, which averaged over 4%. First quarter GDP growth was 1.4% and second quarter GDP growth is expected to be below 2%. While the economy has remained resilient, the labor market is not nearly as tight as it was a year ago. During the second quarter, many economic measures came in below expectations, simply coming down from the torrid pace of 2023.

U.S. GDP growth has slowed significantly in the first half of this year in comparison to the second half of last year, which averaged over 4%. First quarter GDP growth was 1.4% and second quarter GDP growth is expected to be below 2%. While the economy has remained resilient, the labor market is not nearly as tight as it was a year ago. During the second quarter, many economic measures came in below expectations, simply coming down from the torrid pace of 2023.

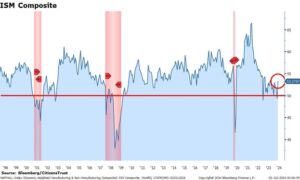

The ISM Composite survey has shown similar volatility but remains above 50. The ISM Composite, which combines the Service and the Manufacturing surveys, had a temporary move below 50, but it only lasted a month, and it has since recovered well into expansion territory. The unemployment rate remains low, and the U.S. economy has never entered a recession when job growth is running at its current pace. During this presidential election year, fiscal (government) spending will also continue to be supportive of economic growth. Revised deficit spending for this fiscal year (ending in October) is now above $1.9 trillion and will be up on a year-over-year basis.

The Quarter Ahead

The Quarter Ahead

Inflation will continue to be the most important economic measure that the Fed and investors are focused on. After a few months of strong inflation readings, both CPI and PPI were weaker than expected in May. This led to a lower reading for Core PCE and encouraged the thought that the downward inflation trend would resume.

Fed Chair Jerome Powell recently expressed satisfaction with the progress on inflation but stated that he wants to see more before being confident enough to cut rates. Well, the time is now, and the Fed will either get what they want in the coming months or will have to buy more time before easing monetary policy. We look forward to serving you and appreciate the trust you have placed in us.

Please reach out to your CitizensTrust representative with any questions you may have. Learn more about CitizensTrust