News & Media

Market Perspectives – First Quarter, 2024

CitizensTrust – A Division of Citizens Business Bank

Click on images below to enlarge.

Equity markets continued to rally in the first quarter in response to relatively strong economic news. The bond market fell slightly as interest rates rose and the Federal Reserve remained on pause, yet continued to signal that their next move would likely be to cut interest rates at some point later this year.

Equity Markets

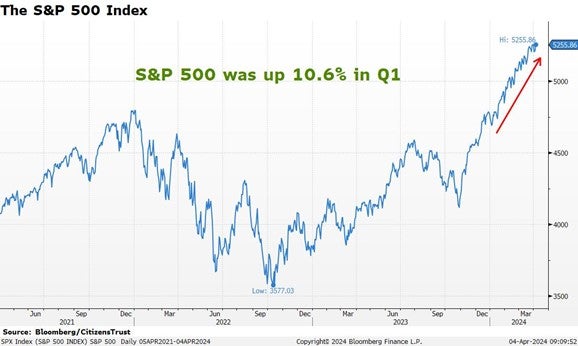

The S&P 500 Index rose an impressive 10.6% in the first quarter adding to the 11.7% gain in the fourth quarter. The recent rally in stocks has seen the S&P 500 reach several new highs during the quarter. It has been over a decade since the S&P 500 last recorded back-to-back gains over 10%. This has happened seven times since 1950 and none of the previous occurrences led to any significant weakness in stocks.

The participation within the equity market continued to broaden out beyond the dominant technology companies that led at the beginning of the rally. The tech-heavy Nasdaq Composite index gained 9.3% in the quarter, slightly lagging the S&P 500. The leading sectors in the first quarter were energy, industrials, and financials. However, the rally continued to be driven by larger companies as the S&P 500 out-performed other benchmarks.

In the first quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, rose 8.5%, and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, rose 5.0%. The U.S. market continued to outpace international indices during the fourth quarter. International Developed markets, as measured by the EFA ETF, rose 6.0% during the quarter and emerging markets, as measured by the EEM ETF, were up 2.2%. Emerging markets were once again negatively affected by the poor performance of Chinese domiciled equities which make up a large portion of the index. International Developed economies have generally not experienced strong economic growth and have not seen upward pressure on GDP estimates like the U.S. has experienced. Globally, the MSCI World Index gained 8.2% in the first quarter.

Interest Rates

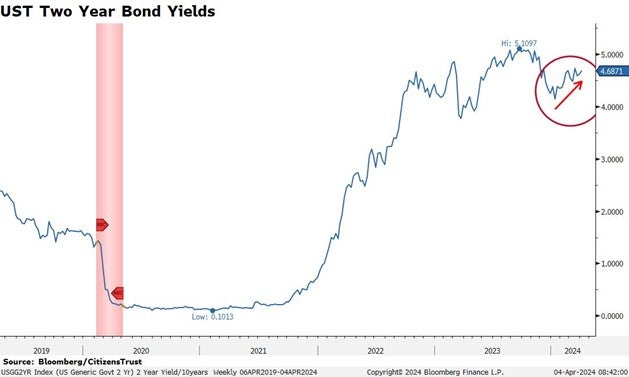

Unlike equities, bonds saw a weaker performance during the quarter as signs of more persistent inflation and stronger-than-expected economic growth led investors to price in fewer rate cuts than what was expected at the beginning of the year. For the fixed income market, the most important story in the first quarter was how U.S. economic data continued to show resiliency and strength despite the highest interest rates in 40 years. This has caused rates to rise after falling sharply in the latter part of last year. The two-year U.S. treasury yield rose roughly 50 basis points during the quarter.

Expectations for the Fed to cut interest rates peaked right at the beginning of the year with the market at one point expecting six or seven rate cuts by the end of this year. After two Fed meetings this quarter and stronger economic growth, those expectations have since been cut in half, and the market now expects three. The last rate hike occurred in July of 2023 and nine months have since past. That is longer than the historical duration from the end of a hiking cycle to the first cut, but the historical periods are highly variable. Fed meetings are scheduled for May, June, and July this summer and the market expects the Fed to change direction sometime during that window.

As yields rose across the treasury curve during the first quarter, bond prices fell. The Bloomberg Aggregate Index, a broad measure of the bond market, declined as a result. The bond market dropped slightly in the first quarter, down 78 basis points. With the time horizon for rate cuts being pushed out, it may likely be another back end loaded year for fixed income returns.

The Economy

U.S. GDP growth was stronger than expected in the fourth quarter of last year, showing a gain of 3.4%. Better-than-expected economic measures throughout this quarter have driven economic growth projections up to 2.5%. The U.S. economy continues to run above its historical trendline. In fact, to illustrate how much economic growth expectations have changed, the average estimate for calendar year 2024 has increased from a near recession-like 60 basis points last summer to a current forecast of 2.2% growth. A remarkable change in less than nine months.

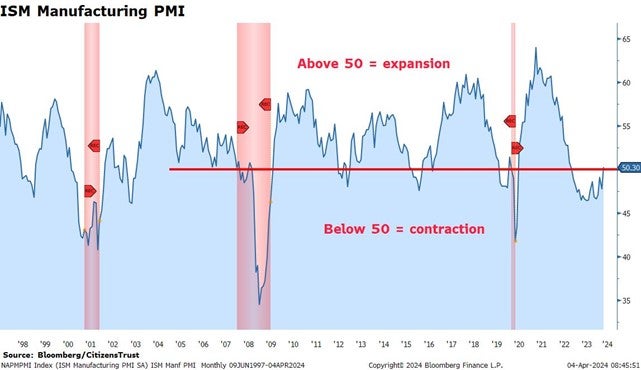

Historically, the manufacturing sector has been a volatile but reliable leading indicator for current economic trends, especially when the trend persists for extended periods. The manufacturing sector has been in contraction since September of 2022, the longest streak in over 20 years. Prior periods of contraction have led to recessions. However, demand distortions and supply disruptions from the pandemic affected many industries and likely did not represent true economic conditions. This measure has recently moved back above 50, indicating expansion, for the first time in a year and a half.

This move to expansion, along with a services sector that remains robust is supportive of continued economic growth. Job growth has also remained strong in the new year, showing monthly gains in excess of 200,000 jobs. The unemployment rate remains low, and the U.S. economy has never entered a recession when job growth is running at its current pace. During this presidential election year, fiscal (government) spending will also continue to be supportive of economic growth. In late March, Congress passed another omnibus spending bill that will fund government spending through the end of the current fiscal year ending in October. Furthermore, the “debt-ceiling” which used to present an obstacle, remains suspended until 2025. Spending will continue unabated, and the U.S. deficit will continue to grow.

The Quarter Ahead

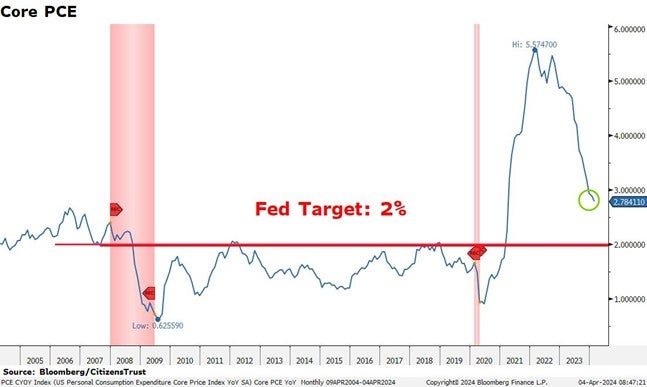

Inflation will continue to be the most important economic measure that investors are focused on. Recent inflation data has shown the declining trend in inflation measures has stalled out. Although Core PCE has dropped slightly, broader measures such as CPI have not shown any real improvement over the past few months. The Fed has explicitly said that they need to see further improvement in inflation in order to start cutting rates.

Working against the Fed’s expectations for lower inflation has been the recent rise in commodity prices. Oil prices are at the highest levels in six months and current prices will lead to higher gasoline prices this summer. Investors will also be watching the labor market closely. The labor market has largely normalized in recent months and is nowhere near as tight as it was. While reported job growth has been strong, revisions to previously reported numbers have been abnormally high. Wage growth has also cooled in recent months and supports lower inflation pressure.

Corporate earnings have remained strong and have now shown year-over-year growth for three straight quarters. As 2024 earnings guidance is largely set by most companies by the end of the first quarter, expectations are for a 10.6% increase in S&P 500 earnings this year and another double-digit increase in 2025. These bottom-up estimates are always subject to revisions, but current expectations represent a positive outlook. In addition, U.S. earnings growth is stronger than most other markets, as is our economic growth, and both remain supportive of relatively high valuations.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust