News & Media

Market Perspectives – First Quarter, 2025

The first quarter of 2025 saw U.S. stocks decline after two strong years of global leadership. Bond prices rose in the quarter as interest rates fell. The Federal Reserve remained on hold, and a new administration began to outline a new economic agenda including efforts to cut back government spending

Equity Markets

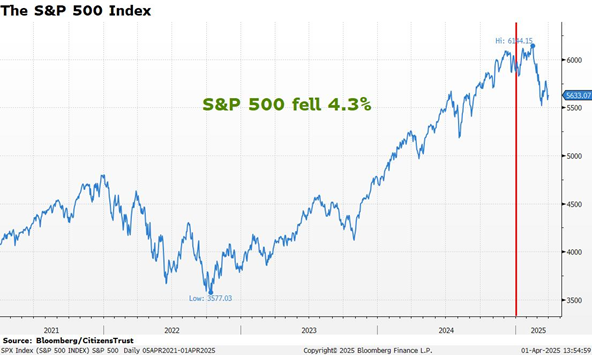

It might be hard to believe that the S&P 500 hit a new all-time high just a few weeks ago. Equity sentiment changed during the first quarter as tariff announcements became a reality and sentiment surveys soured. The S&P 500 Index fell 4.3% in the first quarter after peaking in the middle of February. Equity volatility was relatively subdued last year and it’s no surprise that a new administration with a new economic agenda and a government spending hangover in the trillions of dollars might lead to an increase in equity volatility.

Big technology companies, which have led the rising market in recent years, also led the market down. Every member of the “magnificent seven” that experienced double-digit gains in 2024 has declined by double digits in 2025. Spending on artificial intelligence infrastructure has been robust and forecasts for further growth remained intact during the first quarter, but concerns over an economic slowdown dampened enthusiasm. The NASDAQ Composite Index fell more than twice as much as the S&P 500 and was down 10.3% in the quarter.

For the first quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, fell 3.5% and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, declined 9.5%. The fact that mid-cap stocks outperformed the S&P 500 highlights the impact that the largest weighted technology stocks had on the index.

A dramatic change in the first quarter was the outperformance of international equities versus domestic equities. International Developed markets, as measured by the EFA ETF, gained 8.1% during the quarter, nearly reversing their decline in the fourth quarter of last year. Emerging markets, as measured by the EEM ETF, rose 4.5% in the quarter. China announced several economic stimulus measures that boosted their stock market. Globally, the MSCI World Index fell 0.9% in the first quarter.

Interest Rates

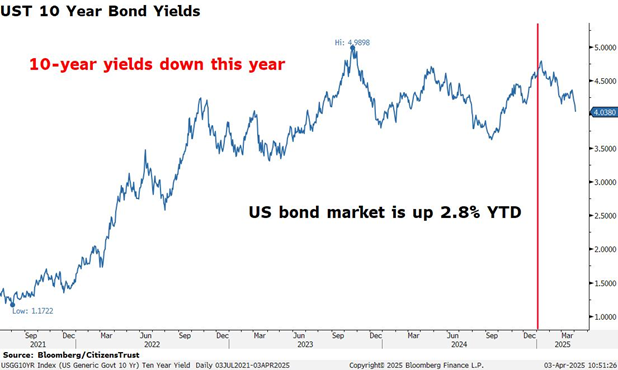

The fixed income market began the year confidently expecting several cuts to the Fed Funds rate, albeit in the back half of the year. This remains the case today as rising economic uncertainty and slower economic growth are expected to lead to further rate cuts. The two-year U.S. Treasury yield agrees with this outlook and has fallen roughly 40 basis points since the beginning of the year. While the Fed is currently “on hold” and considers their current policy stance as restrictive, we expect this to change over the course of the year.

The new Treasury Secretary, Scott Bessent, has clearly stated that the Treasury and the administration would like to see lower yields on the ten-year Treasury bond. This is an obvious priority since roughly 25% of the total national debt, which stood at $36 trillion, needs to be refinanced this year. This significant refinancing need stems from the maturation of existing Treasury securities which were issued at lower interest rates in prior years. Higher interest expenses are straining the federal budget and the lower the ten-year yield, the less the future interest expense burden will be. Assuming that maturing debt is refinanced with ten-year Treasuries, every basis point lower is roughly a billion dollars in lower interest costs.

So far this year, yields have been dropping. Since January, the yield on the ten-year Treasury bond has declined roughly 75 basis points. A “flight to safety” attitude among investors has also helped push up bond prices in recent weeks leading to gains for the bond market. The Bloomberg Aggregate Index, a broad measure of the bond market, gained 2.8% in the first quarter, a solid start for fixed income investors and twice its gain for 2024.

The Economy

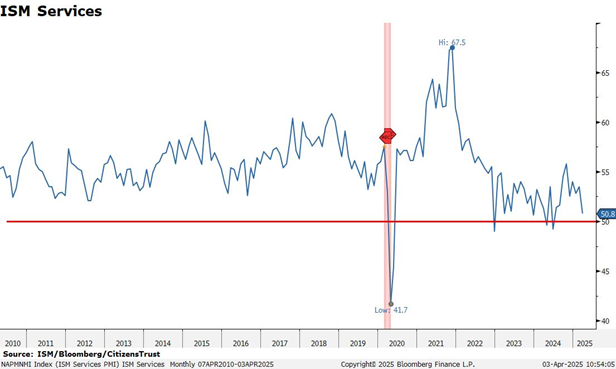

U.S. GDP growth is expected to slow in the first quarter of 2025 after remaining strong through the end of last year. An increase in economic uncertainty and a projected decrease in government spending have lowered growth projections for 2025 and increased the risk of a recession. The ISM Services indicator has remained in expansion territory (above 50) and has rarely contracted over the past 15 years. The U.S. economy is dominated by services and this index would have to fall below 50 for several months for the economy to contract. This indicator will be important to watch in the coming months

Nearly 100 days have passed with the new administration and Trump has declared that globalization is over, and he will tackle the budget deficit. The U.S. has run nearly $2 trillion budget deficits in each of the past two years and virtually everyone agrees that this pace of debt accumulation is unsustainable. The plan to reduce the deficit is basically two-fold: 1) reduce government spending by identifying waste through D.O.G.E. (Department of Government Efficiency) to the tune of $1 trillion, and 2) increase federal revenues by $1 trillion via tariffs and other measures. Both efforts are bold and unprecedented.

The Quarter Ahead

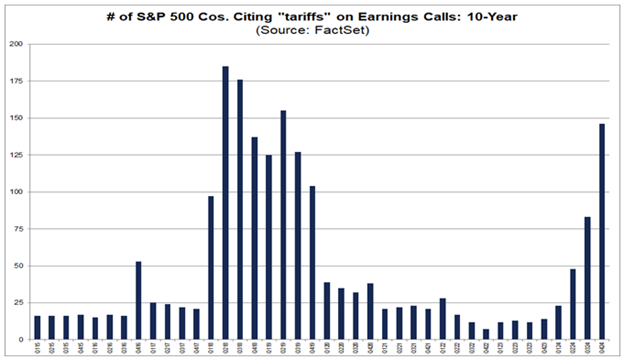

The Trump administration has propelled tariffs into the forefront of any economic discussion. Significant changes to trade policy have historically had measurable impacts on companies’ supply chains and business models. In early April, many new tariffs were announced affecting every significant U.S. trading partner. These actions are the beginning of a global trade war that will be evolving for the foreseeable future. The intent of these tariffs is to raise U.S. revenue and level the playing field for U.S. companies when they do business overseas. While details are currently unfolding, tariffs are now a focal point for the economy and the Fed.

The Fed has been focused on bringing down inflation. While any economic slowdown is deflationary, increasing tariffs can be inflationary, complicating their efforts. Meanwhile, corporate earnings have remained strong, however, revisions to earnings expectations have turned negative in the first quarter. For the S&P 500, a 13% growth rate in earnings was expected for 2025 at the beginning of the year. That expectation has fallen to 10%, largely due to rising economic uncertainty caused by tariff policy. It is common for earnings estimates to start the year high and come down over the course of the year. However, the pace of negative revisions will warrant attention in the second quarter.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust

Content provided by: R. Daniel Banis, Executive Vice President, Head of CitizensTrust Donald Evenson, Senior Vice President, Chief Investment Officer

CitizensTrust is a division of Citizens Business Bank. Trust and Wealth Management are provided by CitizensTrust Wealth Management. The information provided is an opinion on economic outlook and not investment advice. The information is not offered with a product or service. This information is not intended to be a substitute for specific tax, legal, or investment planning advice. We suggest that you discuss your specific questions with your qualified tax, legal or investment advisor.

| Not Insured By FDIC or Any Other Government Agency ● Not Bank Guaranteed ● Not Bank Deposits Or Obligations ● May Lose Value |