News & Media

Market Perspectives – Fourth Quarter, 2024

Financial markets around the globe posted another year of positive returns and the U.S. led the way by a large margin. U.S. stocks saw impressive gains, making it two consecutive years of 20%+ returns for the S&P 500 (2023 gained 26%). The Federal Reserve began cutting interest rates and a Presidential election guaranteed a significant amount of change is in store for the coming year.

Equity Markets

The S&P 500 Index rose 2.4% in the fourth quarter and finished the year with a total return of 25.0%. Equity volatility was relatively subdued all year and the market consistently hit new highs in every quarter.

Big technology companies continued to be some of the best performers for the year. The NASDAQ Composite Index gained nearly 29.6% in 2024 and every member of the “magnificent seven” experienced double-digit gains. Nvidia led the way amongst the biggest tech companies with a gain of 171%. Spending on artificial intelligence infrastructure became a dominant trend in business and U.S. companies are the primary beneficiaries.

For the fourth quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, rose 0.7% and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, rose 0.3%. For 2024, mid-cap gained 15.2% and small-cap gained 11.4%, still under-performing the S&P 500 by a significant margin.

The U.S. market continued to outpace international indices during the fourth quarter. International Developed markets, as measured by the EFA ETF, fell 8.4% during the quarter and gained 3.5% for the year. As with smaller companies, the international markets could not keep up with gains made by the largest U.S. tech companies. Emerging markets, as measured by the EEM ETF, dropped 7.3% in the quarter and finished the year up 6.5%. International equities lack exposure to the positive trends in technology and they were weak in the fourth quarter over potential tariffs emerging from the incoming Trump administration. Globally, the MSCI World Index fell 0.9% in the fourth quarter and posted a total return of 18.0% for the year.

Interest Rates

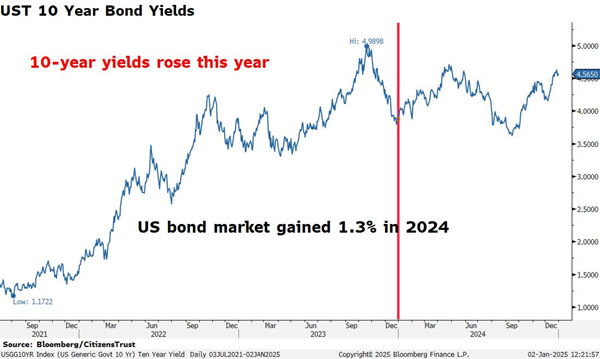

The fixed income market began the year confidently expecting several cuts to the Fed Funds rate. Over the course of the year, the futures market projected a wide range of cuts, from a low of 50 basis points to a high of 1.5%. After some significant progress in the fight against inflation, the Federal Reserve abandoned its “higher for longer” policy and began to move to a less restrictive monetary policy. The Fed began cutting rates in September with a 50-basis point cut and delivered two additional 25-basis point cuts by the end of the year. The resulting 100-basis point drop in the Fed Funds rates is the first decline since the summer of 2019.

In the latter half of 2024, the progress in lowering inflation rates slowed, and the bond market began to lower its expectations for future rate cuts. At this point, the market expects only one or two cuts this year and the Fed will likely be on hold for most of the first quarter. Strong economic growth and stubborn inflation measures in recent months pushed bond yields up near their highest levels of the year.

Overall, the sharp rise in yields over the latter part of the year pushed down bond prices and left fixed income investors with meager gains for the year. Gains in the Bloomberg Aggregate Index, a broad measure of the bond market, peaked at the same time the Fed began cutting the Fed Funds rate in September, and proceeded to fall for the rest of the year. The bond market lost 3.1% in the fourth quarter, leaving the index barely in the black with a total return of 1.25% for 2024.

The Economy

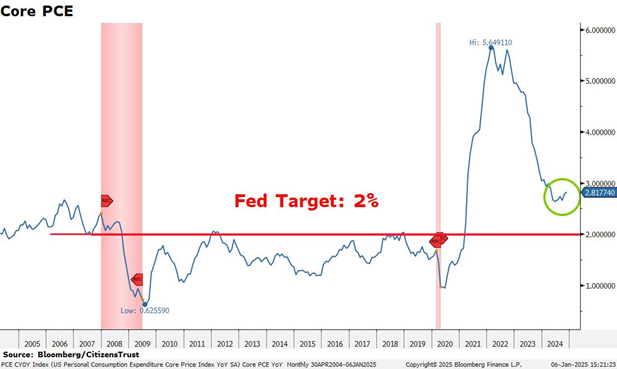

U.S. GDP growth remained strong throughout 2024. The U.S. has run nearly $2 trillion budget deficits in each of the past two years. This unprecedented (outside of COVID) level of peacetime spending has prevented any slowdown from the sharp economic recovery in 2021 and 2022. While there has been much discussion about the Fed’s ability to engineer a “soft landing”, the government may have done it for them. The consequence has been slower progress in taming inflation.

The ISM Services indicator has remained in expansion territory throughout 2024. However, the inflation component of ISM Services has also indicated higher “prices paid” and reached a recent high in December. Government spending has also supported higher services inflation and consumer spending. Until further progress is made in lowering inflation rates, the Fed will have a difficult time justifying lower interest rates. The Fed’s preferred measure of Core PCE has increased every month since last June. For the Fed to reach its self-proclaimed inflation target of 2%, they will need some help from tighter fiscal policy.

After several years of some of the most dramatic policies in U.S. history, more change is going to occur in 2025 with a new Trump administration taking over. Since the election, it appears the new administration is looking to move swiftly to get many of President Trump’s priorities implemented. While the wish list is long, what really gets translated into legislation will play out over several quarters and have impact on future economic growth.

The Quarter Ahead

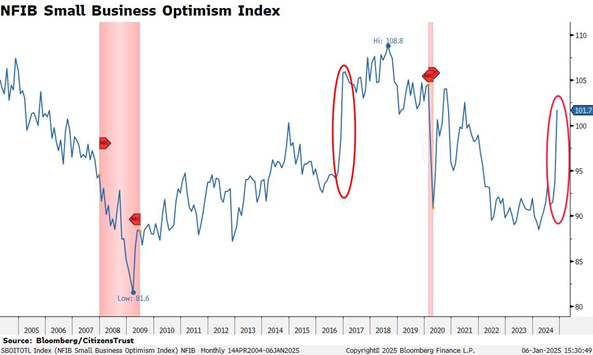

Lower taxes and reduced regulation remain themes of the new administration as was the case back in 2016. Both priorities tend to resonate well with small business owners who also have a significant impact on the labor market. The last time Trump was elected, there was an immediate spike of ten points in the Small Business Optimism Index. In the first month after this election, we have seen a similar spike. This may be relevant to the job market if history repeats itself. In 2017, the index continued to rise to a multi-decade high. Over the three-year period from 2017 to 2019, the U.S. economy added 8 million fulltime jobs. While the labor market has been steady recently, fulltime jobs have stagnated since the end of 2022. Despite the reported increases in Non-Farm Payrolls, which include part-time jobs, fulltime jobs have only increased by 885,000 over the past two years. An increase in business confidence will likely have a positive effect on the quality of job growth, which is positive for economic growth and household formation.

Corporate earnings have been strong and continue to point to a robust growth outlook in 2025. Consensus expectations are for 13% earnings growth and an operating margin of 13.7% in the coming year. If achieved, that would set a record for S&P 500 profitability. The rise in profitability is driven by dominant technology companies which have larger profit margins. Other industries have struggled to return to pre-pandemic profit levels and a pro-business, less regulation environment may expand growth opportunities beyond the technology sector.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust

Content provided by: R. Daniel Banis, Executive Vice President, Head of CitizensTrust Donald Evenson, Senior Vice President, Chief Investment Officer

CitizensTrust is a division of Citizens Business Bank. Trust and Wealth Management are provided by CitizensTrust Wealth Management. The information provided is an opinion on economic outlook and not investment advice. The information is not offered with a product or service. This information is not intended to be a substitute for specific tax, legal, or investment planning advice. We suggest that you discuss your specific questions with your qualified tax, legal or investment advisor.

| Not Insured By FDIC or Any Other Government Agency ● Not Bank Guaranteed ● Not Bank Deposits Or Obligations ● May Lose Value |